KY DoR 51A209 2007-2024 free printable template

Show details

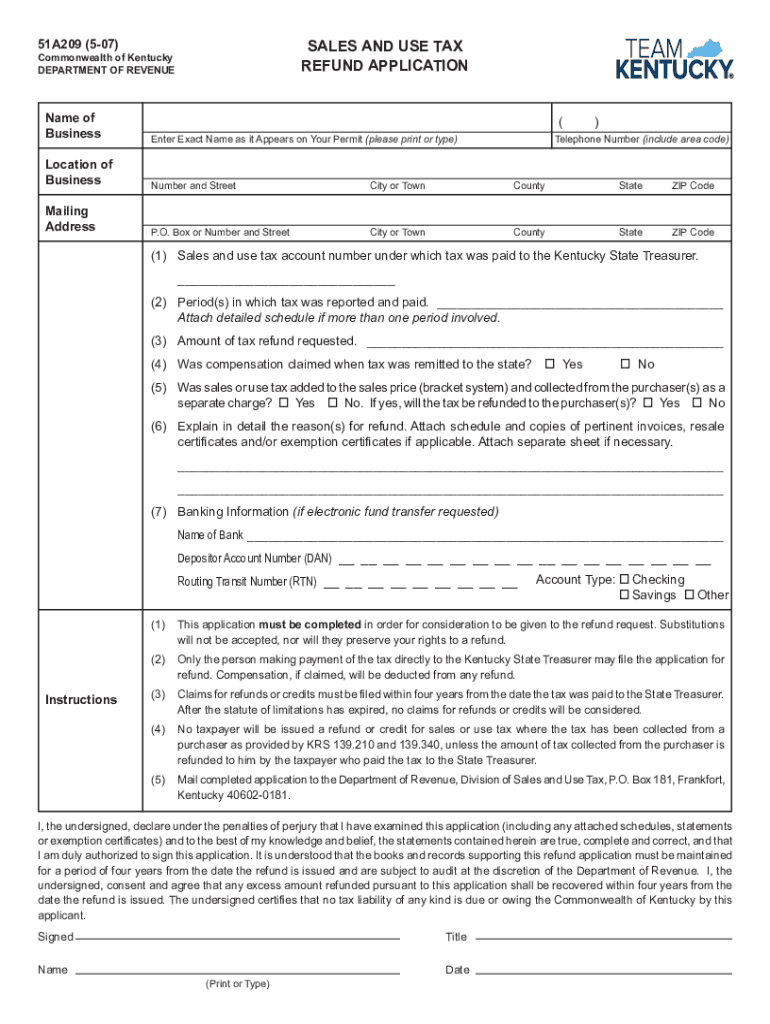

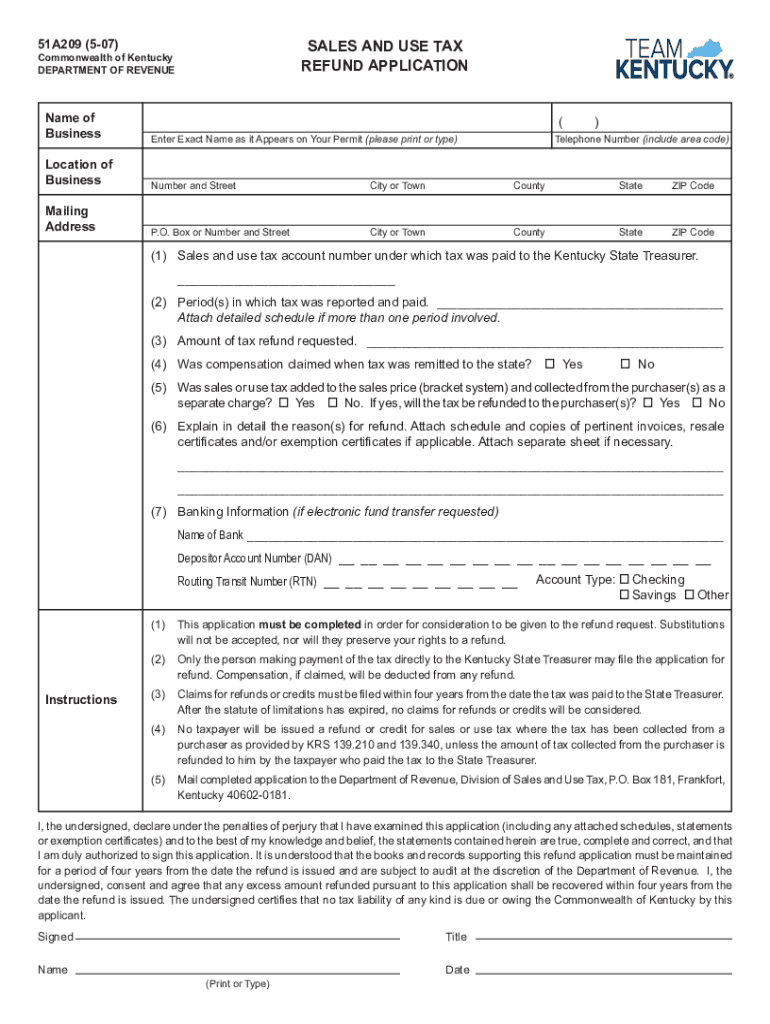

51A209 (5-07) SALES AND USE TAX REFUND APPLICATION Commonwealth of Kentucky DEPARTMENT OF REVENUE Name of Business Location of Business Mailing Address (Enter Exact Name as it Appears on Your Permit

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax refund form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax refund form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax refund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax refund application form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out tax refund form

How to fill out refund Kentucky forms:

01

Start by gathering all necessary documentation, such as receipts and relevant financial information.

02

Carefully read the instructions provided with the Kentucky refund forms to understand the requirements and ensure you have all the necessary information.

03

Begin filling out the forms accurately, providing all requested personal and financial information.

04

Double-check your entries for any errors or omissions.

05

Attach any required supporting documentation and make sure it is labeled correctly.

06

Sign and date the form as required.

07

Make a copy of the completed form and all supporting documents for your records.

08

Submit the form and supporting documents to the appropriate department or address specified in the instructions.

09

Keep track of the status of your refund and follow up if necessary.

Who needs refund Kentucky forms?

01

Individuals who have overpaid their taxes in the state of Kentucky may be eligible for a refund.

02

Anyone who has been issued a tax credit or rebate that exceeds their tax liability may need to fill out refund Kentucky forms.

03

People who have made qualifying purchases for which they are entitled to a refund, such as for certain products or services, may need to complete these forms.

Video instructions and help with filling out and completing tax refund

Instructions and Help about refund kentucky get form

Fill tax refund application form : Try Risk Free

People Also Ask about tax refund

What is the number for the Kentucky state refund?

Why did I get a refund from the government?

When can I expect my Ky state refund?

Does Kentucky do direct deposit?

When can I expect my Kentucky tax refund?

Does Kentucky direct deposit refunds?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file refund kentucky s?

Generally, individuals are required to file a Kentucky state tax return if they meet certain income thresholds or have specific types of income. However, it is recommended to consult the Kentucky Department of Revenue or a tax professional for specific guidance based on individual circumstances.

How to fill out refund kentucky s?

To fill out a refund form in Kentucky, follow these steps:

1. Obtain the correct form: Visit the Kentucky Department of Revenue website or contact them directly to request the appropriate refund form. The specific form will depend on the type of refund you are seeking (such as income tax, sales tax, or property tax).

2. Gather necessary documentation: Collect all relevant documents and information needed to support your refund claim. This may include previous tax returns, receipts, invoices, or any other documentation related to your claim.

3. Fill out personal information: Provide your personal details, including your name, address, social security number, and contact information. Make sure to fill out all required fields accurately and completely.

4. Complete refund details: Specify the type of refund you are seeking and provide details about the specific refund claim. This may include the tax year or period, the amount of tax paid, and any relevant explanations or justifications for the refund.

5. Attach supporting documentation: Include any supporting documents, such as receipts or invoices, that substantiate your claim for a refund. Make sure to organize these documents in a clear and organized manner.

6. Review and double-check: Carefully review the completed form and verify that all information provided is accurate and complete. Check for any errors or inconsistencies before submitting the form.

7. Submit the form: Sign and date the form where required and submit it according to the instructions provided. This may involve mailing the form to the appropriate department or submitting it electronically through an online portal.

8. Keep a copy for your records: Make a copy of the completed form and all supporting documentation for your own records. This will help you if any issues or questions arise regarding your refund claim.

9. Follow up if necessary: If you do not receive your refund within the expected timeframe, or if you have any questions or concerns about the status of your refund, reach out to the Kentucky Department of Revenue for assistance.

Note: The specific steps and process may vary depending on the type of refund you are seeking and the specific form provided by the Kentucky Department of Revenue. It's always a good idea to read the instructions and follow them carefully to ensure accurate and timely processing of your refund claim.

What is the purpose of refund kentucky s?

Refund Kentucky S is a specific type of refund requested by the Kentucky state government. The purpose of these refunds is to provide financial reimbursements to eligible individuals or entities who have overpaid or paid more in taxes than they owe to the state of Kentucky. This can include income tax refunds, property tax refunds, sales tax refunds, or refunds for other state taxes and fees. The refunds aim to ensure that taxpayers receive the appropriate amount of money they are owed by the state government.

What information must be reported on refund kentucky s?

When reporting a refund in Kentucky, the following information must be included:

1. The taxpayer's name and identification number (such as Social Security Number or Employer Identification Number).

2. The tax year for which the refund is being claimed.

3. The amount of the refund being claimed.

4. The type of tax for which the refund is being claimed (e.g., income tax, sales tax, property tax, etc.).

5. Any supporting documentation or explanation for the refund, if required.

6. The taxpayer's current contact information, including mailing address and phone number.

7. Any additional information or forms as required by the Kentucky Department of Revenue.

It is important to consult the specific guidelines provided by the Kentucky Department of Revenue or seek professional advice for accurate and up-to-date information on reporting refunds in Kentucky.

What is the penalty for the late filing of refund kentucky s?

The penalty for late filing of a refund in Kentucky depends on various factors, including the category of tax and the amount owed. Generally, if you file your refund late and owe taxes, you may be subject to penalties and interest charges.

For individual income tax returns, there is a late filing penalty of 2% per month (up to 20%) on the unpaid tax amount, plus interest at the current rate. Additionally, there may be a minimum penalty of $10 or 5% of the unpaid tax, whichever is greater.

It is important to note that specific penalty amounts and provisions may vary, so it is recommended to consult with the Kentucky Department of Revenue or a tax professional for accurate and up-to-date information based on your individual situation.

How can I edit tax refund from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your tax refund application form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete tax refund application pdf online?

pdfFiller has made it easy to fill out and sign 51a209 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit ky form 51a209 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing refund kentucky search form.

Fill out your tax refund form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Refund Application Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to refund kentucky form

Related to refund kentucky s

If you believe that this page should be taken down, please follow our DMCA take down process

here

.